The objective of an instant asset write-off policy is to stimulate economic growth by encouraging businesses to invest in new assets.

For the past two years, annual legislation was required to increase the maximum asset value from $1,000 to $20,000 in response to previous Federal Budget announcements. In the recent Federal Budget, the government did not mention the scheme – however the Prime Minister made an election pledge to extend the $20,000 instant asset write-off for another 12 months (until 30 June 2026). Without this pledge, the threshold for immediate asset deductions would revert to $1,000 from July 1, 2025.

Understanding the instant asset write-off

The instant asset write-off allows eligible businesses to immediately deduct the full cost of qualifying assets in the year they are first used or installed, rather than depreciating them over several years. This immediate deduction improves cash flow, enabling businesses to reinvest in their operations more readily.

Available to businesses with an aggregated turnover of less than $10 million, the instant asset write-off can be used for:

With the limits changing almost annually each year, it makes it hard for businesses to plan investments into their business. And when you look at the limits in place over the past five years, it’s easy to see why:

What does the Coalition say?

To provide small businesses with greater certainty and encourage investment in new assets, the Coalition has committed to making the instant asset write-off permanent with a threshold of $30,000, if elected.

The MFAA view

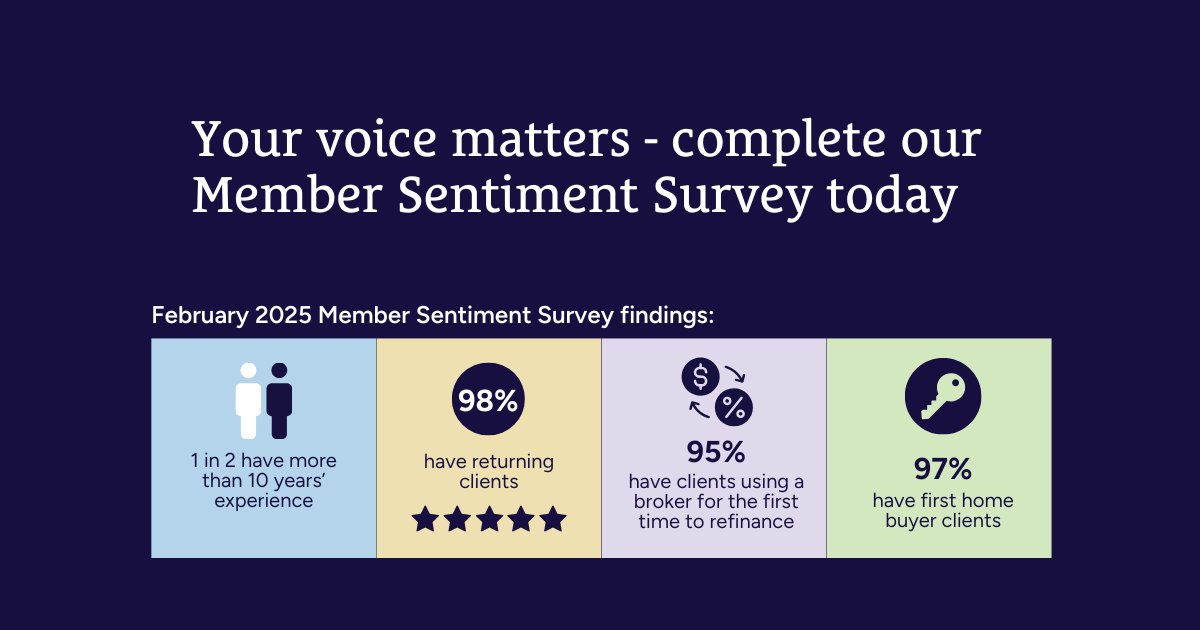

Our members increasingly support small business customers with their commercial lending and asset finance needs. Small businesses, including our members, need certainty so they can plan for the long term. The MFAA share the same view as the Commercial and Asset Finance Brokers of Australia (CAFBA) and COSBOA in advocating for the instant asset write-off to be increased and be made permanent.

You can sign up for free by creating an account. If you are new to the portal, select "Create an account" to register and gain access to a range of free and useful resources.

If you already have an account, simply log in. Once logged in, you can easily apply for membership. If you need assistance, call our support team on 1300 554 817 for assistance.