The Mortgage & Finance Association of Australia (MFAA) has launched its six-monthly Member Sentiment Survey, open from 1 August to 31 August.

The survey invites MFAA broker members across the country to share their insights on borrower trends, shifts in market conditions and how they are supporting the evolving needs of their clients.

Findings from the survey provide a critical evidence base that supports MFAA members, contributes to broader industry understanding, and directly informs the association’s policy and advocacy agenda with government, regulators and other key stakeholders.

“Economic conditions continue to shift and so do the needs of borrowers and how mortgage brokers are supporting their clients.

“The Member Sentiment Survey is a crucial tool that identifies real-time insights and “lead indicators” around how borrowers are faring in the current economic environment across a range of factors, including interest rates, housing supply and cost of living,” said MFAA CEO Anja Pannek.

“The hard data we gain from these surveys is key in advocacy for our members and in how we shape the future of our industry.”

“Insights from prior surveys has directly informed our activities, for example the MFAA’s call for a dynamic serviceability buffer in its submission to the Inquiry into the 2024 Financial Regulatory Framework and Home Ownership.”

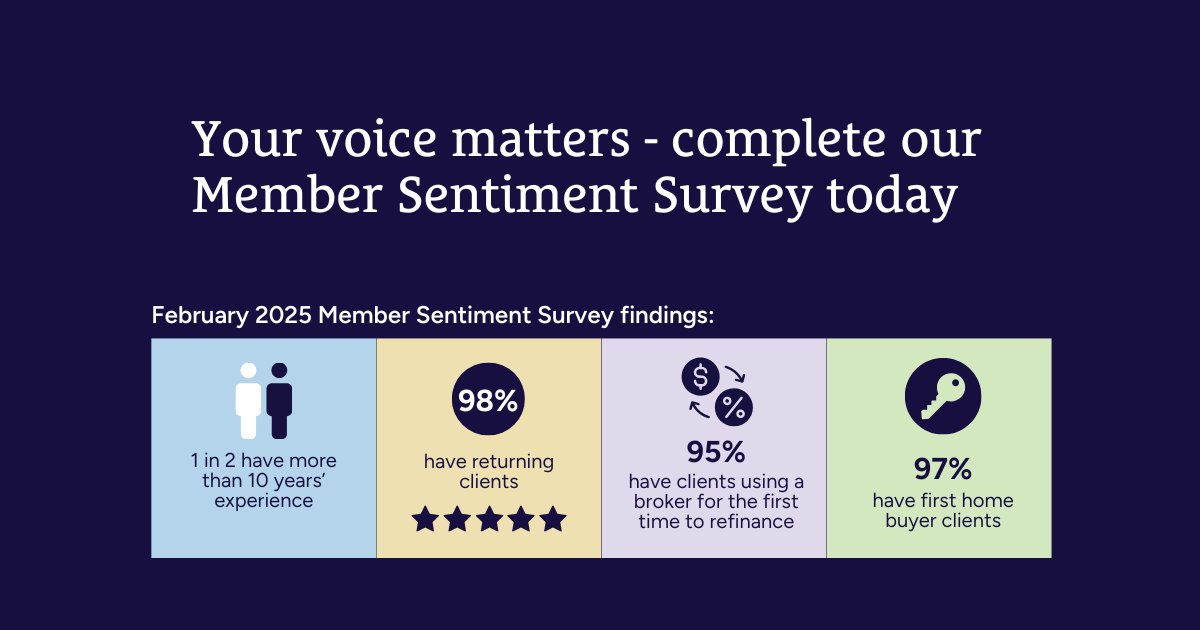

Research from the MFAA’s February 2025 Member Sentiment Survey revealed signs of easing mortgage stress, with many homeowners finding it easier to refinance and switch to more suitable loan products.

While some serviceability challenges remained, brokers reported a clear shift in borrower confidence.

“Since the February survey, the Reserve Bank has delivered two rate cuts — once during the survey period in February and again in May and then a surprise hold decision in July,” Ms Pannek said. “We are keen to see how this has impacted borrower sentiment, given continuing constraints in the housing market.”

Responses from this Member Sentiment Survey will further support the MFAA’s work across current policy priority areas including:

Insights from the MFAA’s previous surveys can be found here.

The August Member Sentiment Survey takes just five minutes to complete, and the insights you provide will help shape the future of lending policy in Australia.

Responses are anonymous and survey respondents who choose to provide their details will go into the draw to win a $150 Visa gift card.

MFAA members can access the August Member Sentiment Survey here.

You can sign up for free by creating an account. If you are new to the portal, select "Create an account" to register and gain access to a range of free and useful resources.

If you already have an account, simply log in. Once logged in, you can easily apply for membership. If you need assistance, call our support team on 1300 554 817 for assistance.