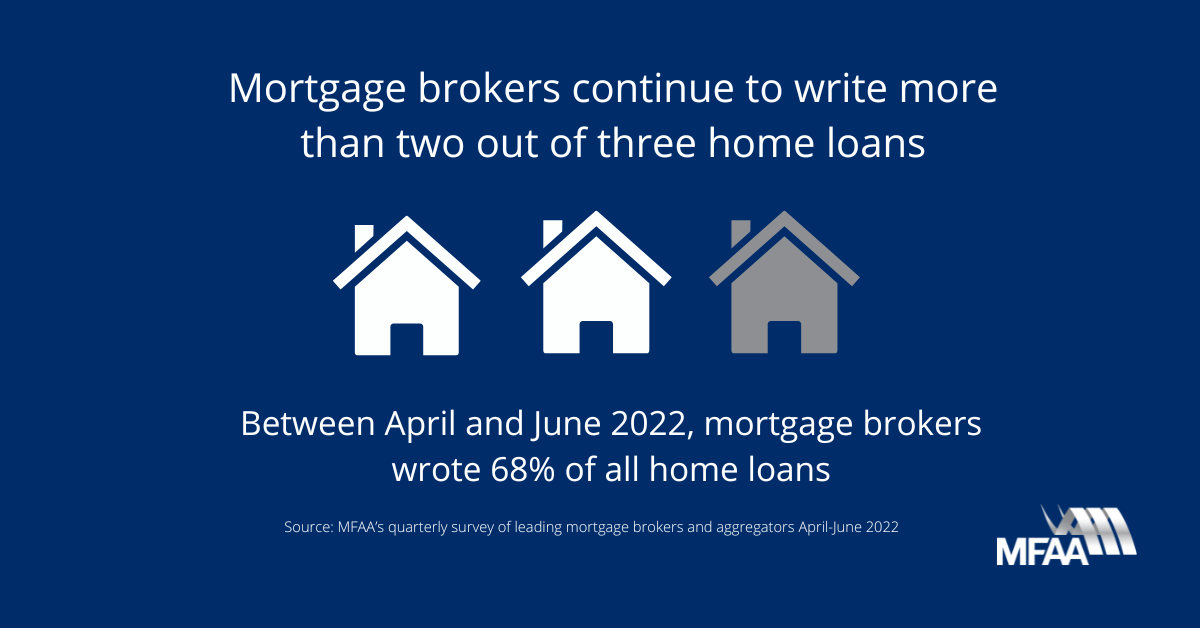

During the June quarter of 2022, mortgage brokers facilitated 68% of all new residential home loans, according to the latest data released by research group Comparator, a CoreLogic business, and commissioned by the MFAA.

This result is the highest for a June quarter since the measure has been tracked and a significant 9 percentage point increase compared to 59% achieved in the same quarter in 2021 and 11 percentage point increase on the 57% recorded in the June 2020 quarter.

The value of home loans settled by mortgage brokers reached a new peak at $96.08 billion during the quarter. Not only is this the highest value of broker originated home loan settlements for any quarter on record, it represents a 23.58% year-on-year increase and an increase of 81.97% compared to the equivalent quarter in 2020.

“This is an incredible result for mortgage brokers, particularly in an environment of rising interest rates and a slowdown in the property market,” said incoming MFAA CEO Anja Pannek.

“It is clear from the strong growth in the proportion of home loans written by mortgage brokers over the past few years that customers value the service mortgage brokers offer.

“Market conditions like we are seeing now further highlight the benefits of using a mortgage broker who can explain the array of different lenders, products and options available to their clients.”

Ms Pannek commented that these results further demonstrate ongoing increases in consumer trust and confidence in the industry, following five years of successful reform.

Comparator compiles quarterly broker statistics for the MFAA by calculating the value of loans settled by 18 of the leading brokers and aggregators as a percentage of ABS Housing Finance commitments. The MFAA releases these statistics each quarter. This data can only be used publicly by referencing the MFAA as the owner of the data and its use in communications.