From 1 July 2022, changes to the way hardship arrangements are reported on credit reports will take effect.

It is important that MFAA members are aware of these new reforms to support their customers in understanding how financial hardship arrangements will be reflected in their customers’ credit report.

What’s changing

Currently, financial hardship arrangements cannot be reported in the credit reporting system. In many cases, this means that the repayment history in your customer’s credit report will show a ‘blank’ or even ‘missed’ payments during the hardship arrangement. However, this approach does not tell the full story about your customer’s credit history.

From 1 July 2022, the credit reporting system will be much clearer, with the introduction of 'financial hardship information'. If a lender agrees to a financial hardship arrangement that reduces your customer’s loan repayments, then their credit report will show:

- That they are ‘current and up to date’ with payments (i.e. ‘0’ or a ✔) for that month provided they make those reduced payments on time; and

- A 'flag' alongside the repayment history information, indicating that a special payment arrangement was in place.

The flag in the credit report will be referred to as 'financial hardship information' and can take two forms depending on the type of arrangement:

- ‘A’ – There was an arrangement for the month that temporarily deferred some or all your customer’s repayments (which will need to be repaid later or be subject to a further arrangement).

- ‘V’ – The loan was varied in this month to reduce your customer’s repayments. This could be either for a short term (for example, reduced payments for three months) or long term (for example, extending the remaining term of the loan; waiving some of the debt etc).

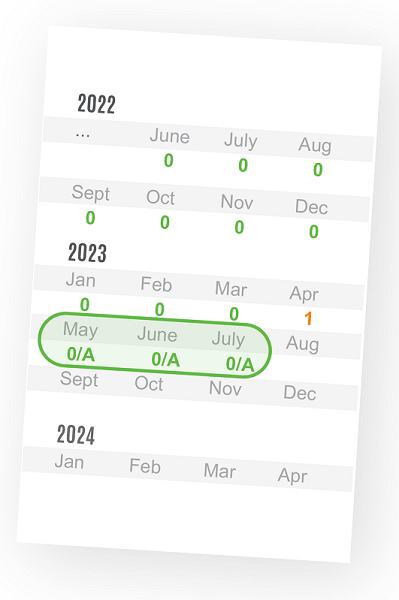

The financial hardship information ‘flag’ will only stay on your customer’s credit report for 12 months (compared to repayment history information itself which stays for 24 months). See the example below.

Example credit report showing hardship flag and RHI

How will financial hardship information be used by the lender?

The hardship reporting changes are intended to give borrowers the ability to ‘protect’ their credit report if they experience financial hardship, while also facilitating better lending decisions. The financial hardship information may prompt prospective lenders to make further inquiries to better understand an applicant’s situation – for example, if the hardship arose from job loss or reduced hours, are they back in stable employment?

The reforms also include some important protections for consumers. Importantly, financial hardship information cannot be used by a credit reporting body to calculate your customer’s credit score (whereas regular repayments that are missed by your customer outside a hardship arrangement will impact their credit score). Plus, a lender can’t cancel a customer’s existing credit card limit just because their credit report includes financial hardship information.

Resources to help your customer

CreditSmart (a consumer education resource developed by the Australian Retail Credit Association) has developed this infographic that sets out the basics of the new hardship reporting framework in simple, consumer-friendly terms.

MFAA members can give this infographic to their customers when explaining what will be recorded on the customer’s credit report if they seek financial hardship assistance.

From 1 July, the CreditSmart website will have a range of information that can be used by both brokers and by their customers to understand the new hardship reporting framework.