The Mortgage and Finance Association of Australia (MFAA) has released the latest Industry Intelligence Service Report (IIS) 12th edition providing insight into a period of uncertainty within the Australian economy.

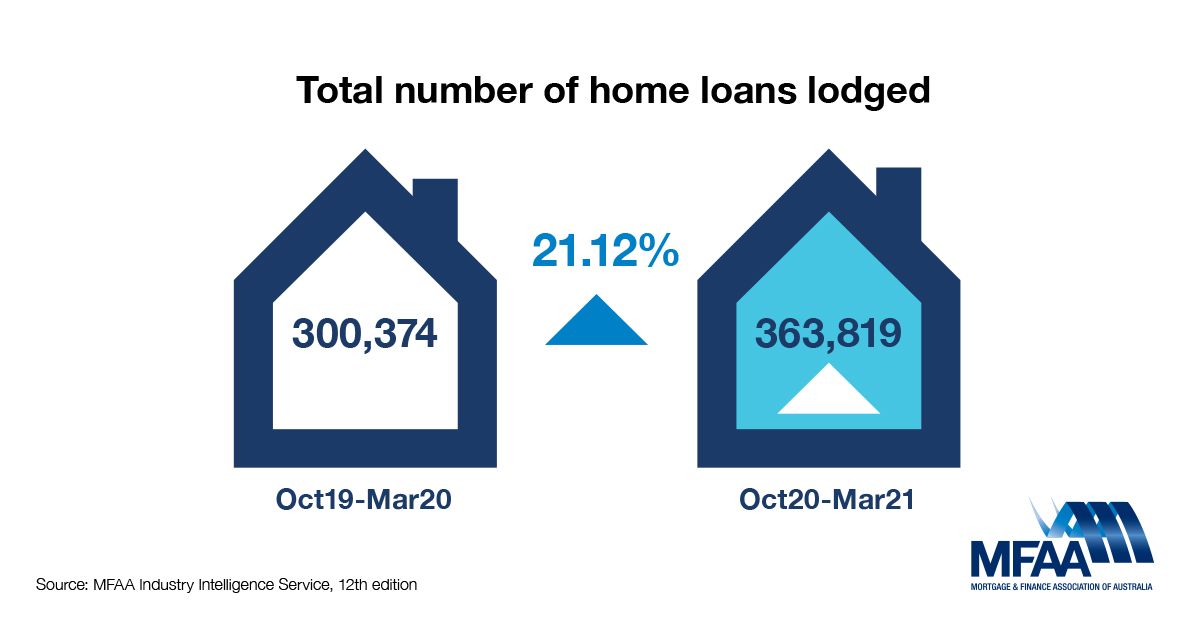

The IIS Report 12th edition, which draws on data supplied by 12 of the industry’s leading aggregator brands, provides broker and industry performance and demographic data for the six-month period of 1 October 2020 to 31 March 2021.

The October 2020 to March 2021 term was a buoyant period for the mortgage broking industry during which ongoing stimulus measures and record low interest rates combined to drive consumer sentiment and the domestic residential property market.

MFAA CEO Mike Felton said, “As evidenced in the report, mortgage brokers were able to assist a record number of customers in taking advantage of the historically low interest rates and strength in the market and in doing so achieved some of their most positive results to date.

“The broker channel settled $122.81 billion in residential home loans for the six-month period, the highest value recorded for any six-month period since the MFAA commenced reporting in 2015, up 24.4% year-on-year.

“This result was indicative of a strong performance across the board from the nation’s mortgage brokers with up-front commissions growing by a significant 19.93% year-on-year, reaching $94,096 per broker for the period. This helped to achieve a healthy national average combined remuneration per broker of $161,894 per annum, or a 14.55% increase year-on-year, despite a 3.5% increase in the number of brokers in the industry.”

Despite these overwhelmingly positive results for the industry, Mr Felton said, “Disappointingly though, the proportion of female brokers has seen a decline to the lowest observed level, even as the total broker population recovered and increased period-on-period.”

After boosting market share through the provision of much needed liquidity to the home loan sector during the 2020 recession, the period between October 2020 and March 2021 has seen the downward trend of the market share of the major banks resume with a 7.6 percentage point decline from 51.7% to 44.1%.

“Overall, October 2020 to March 2021 was a positive period for the mortgage broking industry, as brokers responded to customer demand driven by record low interest rates, government support and a buoyant national housing market,” said Mr Felton.

For further information, please contact: Stephen Hale, Head of Marketing & Communications on 0472 868 095 or stephen.hale@mfaa.com.au