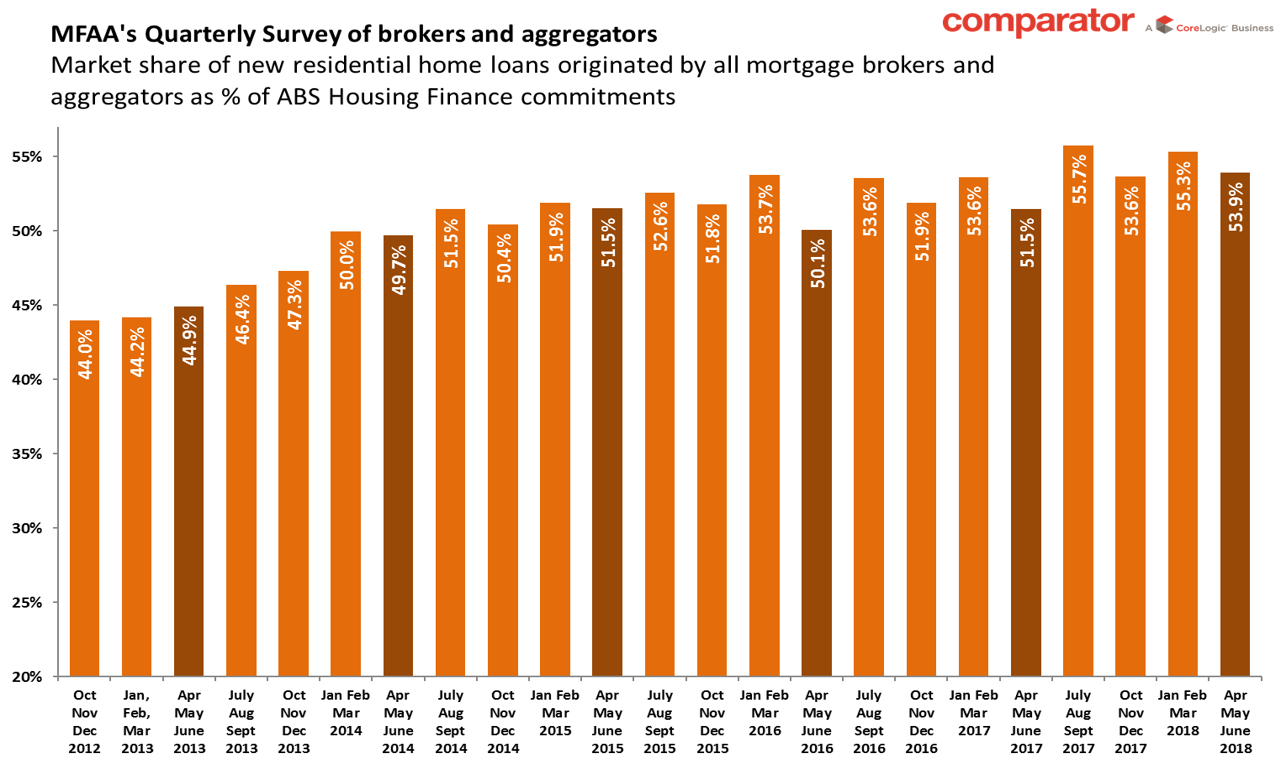

Consumers are continuing to turn to mortgage brokers in ever-growing numbers, demonstrating their trust and confidence in the broker community, according to the latest quarterly data on market share.

New data released by research group comparator, a CoreLogic business, has shown a continuation of strong growth in market share. Brokers settled 53.9 per cent of all new residential home loans during the June 2018 quarter, compared to 51.5 per cent for the same quarter last year. The June 2018 quarter was also the strongest June quarter ever recorded in what is traditionally a seasonally-low quarter for broker market share.

MFAA CEO Mike Felton said the data was further evidence of the value and service that mortgage brokers deliver to customers and the economy.

“This result is a triumph for our members, whose exemplary work for their customers has risen above the current scrutiny and media attention.

“Mortgage brokers settled $49.5 billion in residential home loans in the quarter, which is the largest dollar value recorded for the broker channel for the seasonally-low June quarter since data collection commenced in 2012,” Mr Felton said.

“The 2.4 percentage point increase on the same quarter in 2017 is also the biggest increase between like quarters since December 2014 and is made even more significant by the fact that the quarter coincided with the Royal Commission hearings.

“This result is a testament to the remarkable work of brokers and their commitment to quality service. According to a recent report by Deloitte Access Economics, mortgage brokers on average have 13.8 years’ industry experience. This expertise underpins the trust and confidence that consumers have in their broker, and the value that expertise is delivering,” he added.

Comparator compiles quarterly broker statistics for the MFAA by calculating the value of loans settled by 18 of the leading brokers and aggregators as a percentage of ABS Housing Finance commitments. The MFAA releases these statistics each quarter.