The Mortgage and Finance Association of Australia (MFAA) has released the latest Industry Intelligence Service Report (IIS) 13th edition providing insight into a period of strong activity in the home loan market.

The report, which draws on data supplied by 11 of the industry’s leading aggregator brands, provides broker and industry performance and demographic data for the six-month period of 1 April 2021 to 30 September 2021.

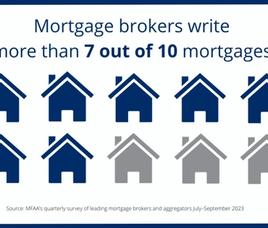

Throughout the period mortgage brokers were key players in the majority of home loans and in the September 2021 quarter, mortgage brokers facilitated more than two in three of all new residential mortgages, recording the highest ever market share across any quarter at 66.9%.

“The April to September 2021 period was, like much of the past two years, marked by significant disruption with lockdowns in many states, particularly the eastern states,” said MFAA CEO Mike Felton.

“Brokers have continued to show that they are here to support customers seamlessly throughout these periods of disruption and changes in business practices. This research shows consumers recognise, and appreciate, this continuity of service.

“This was also the first full reporting period brokers were operating under the full suite of reforms implemented over the past two years, including the unrivalled Best Interests Duty, giving consumers even greater trust and confidence in the broker channel.”

The broker channel settled $165.96 billion in residential home loans for the six-month period, the highest value recorded for any six-month period since the MFAA commenced reporting in 2015, up 54.4% year-on-year.

Broker commissions increased during the period with gross annual earnings up 23.9% year-on-year to $188,046. Up-front commission for the six-month period saw significant growth increasing 39.21% to an average of $117,992, while trail commissions saw a smaller increase of 3.3% to $70,054.

“More mortgage brokers than ever are now also writing commercial lines,” said Mr Felton.

“This indicates brokers are diversifying their business and assisting their customers with a wider range of their financing needs.”

Disappointingly, the report shows that the proportion of female brokers has dropped slightly from an already low base.

“While the number of female brokers increased slightly during the period, the proportion of female brokers in the overall broker population has not seen the same increase indicating that there is clearly a lot more work to be done to increase female participation in our industry,” said Mr Felton.

The market share of the major banks recorded a 5.1 percentage points decrease in the September 2021 quarter, the largest decline observed in a quarter by any segment to date.

“The six months to September 2021 was a positive time for the mortgage broking industry, as market share benefitted from reforms implemented and brokers continued to respond to consumer demand driven by record low interest rates, a shortage of supply and government support programs combined with higher household savings and the normalisation of remote work,” said Mr Felton.